Does Locking Your Capital One Credit Card Prevent Future Charges From A Vendor You No Longer Do Business With?

It largely depends on whether Capital One considers the vendor's prior string of charges to be "new" or "recurring."

In theory, yes: locking your Capital One credit card will prevent future charges from a vendor you no longer do business with.

...but with one main caveat.

Here's the caveat: it matters whether the future charge is considered a new charge or, instead, a recurring charge.

How does a card lock work, then, given this distinction between a new and recurring charge?

Once you lock your Capital One credit card, if a given future charge by a vendor comes through as a new charge, then the card lock should operate to prevent that charge attempt.

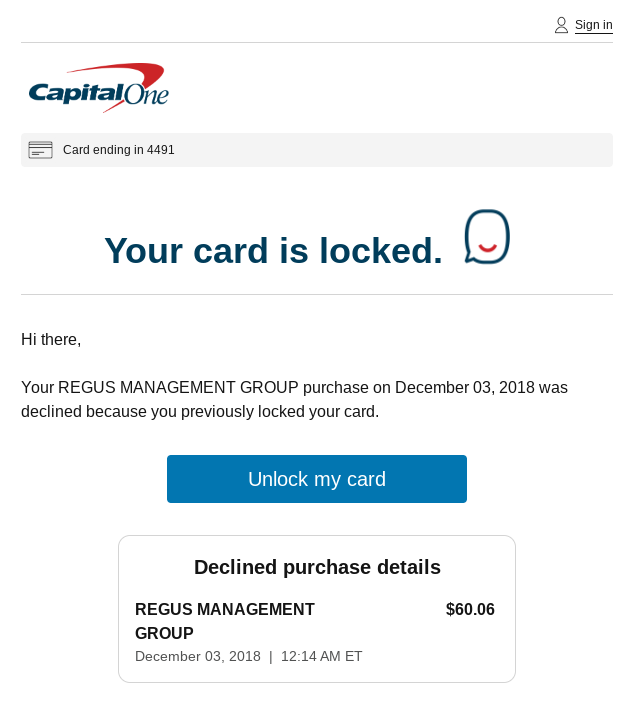

...and, when that happens, you'll typically receive an automated email alert about the charge attempt (example depicted below).

But the key question is whether that charge attempt is designated as a new charge or, instead, as another iteration of a recurring charge which you had previously authorized.

Why does Capital One distinguish between a new charge and a recurring charge for the purposes of a card lock?

Here's how Capital One explains the distinction:

How do credit card locks work?

Locking a credit card prevents the card from being used to make most new purchases. Generally, your credit card company will continue to authorize any recurring charges you already approved, like subscription payments or automatic bill-pay. This can help prevent you from losing access to services or falling behind on bills while preventing authorization of other new charges.

So, Captial One's card-lock feature continues to process future recurring charges, on the assumption that your previous authorization of those charges indicates your ongoing desire for those charges to be processed.

How do you tell if a charge by a vendor is considered a new charge or a recurring charge?

Since the title of this article describes a situation in which you, (a) at one point, did business with a given vendor, but then, (b) at some point thereafter, ceased to do business with that vendor, it is probably the case that your Capital One account would have records of prior charges from that vendor. This record of prior charges should make it easier for you to determine whether Capital One would consider a future charge from that vendor to be new or recurring--because you should be able to either...

- Look at each charge instance yourself, in your online Capital One account, paying particular attention to any designation (i.e. "recurring" or "subscription" or not) indicated by the charge instance's record description; or

- Call Capital One directly, let's say, to ask them to tell you how a string of charges from that has been designated so far.

Think of this inquiry, then, as Step 1 to locking your Capital One credit card to prevent future charges from a vendor you no longer do business with: determine whether Capital One considers the vendor's prior string of charges to be new or recurring.

Think of this inquiry, then, as Step 1 to locking your Capital One credit card to prevent future charges from a vendor you no longer do business with: determine whether Capital One considers the vendor's prior string of charges to be new or recurring.

If the vendor's past charges to your Capital One card were designated as new, then you could reasonably expect future charges from that vendor to be similarly designated--and, in that case, locking your Capital One credit card should prevent future charges from that vendor.

(But what if the vendor's past charges to your Capital One card were designated as recurring? How then could you prevent future charges from that vendor to your Capital One credit card? Good question: we answer that question here.)