Looking For An Office To Rent In Jacksonville? Good Luck Avoiding Regus

If Regus's advertisements were harder to find, then the problem would not be so big. But since the opposite is true--they're hard to avoid--the scale of Regus's reported false advertisement is, or at least should be, a matter of public concern.

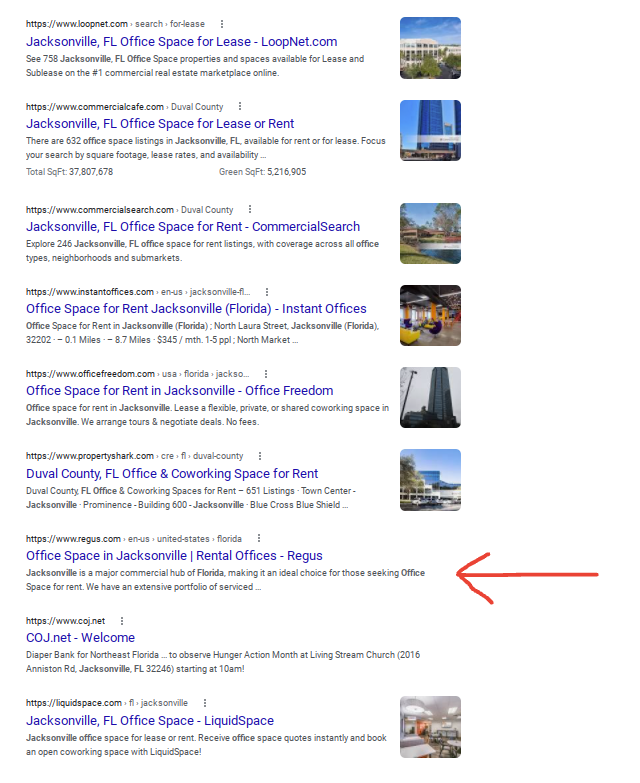

Jim needed a new office space in Jacksonville. So, he started with a Google search for: office jacksonville florida.

That's where he first encountered Regus.

The Google Search Results

The page 1 search results listed fifteen URLs for Jim to click on. Ten of those URLs were "organic," and five of those URLs were "paid" (i.e. paid advertisements). In order of appearance, from top to bottom, those page 1 results featured URLs on websites run by the following brands:

- LoopNet [Ad]

- Fresh Cowork [Ad]

- Regus [Ad]

- Easy Offices [ Ad]

- LoopNet

- CommercialCafe

- CommercialSearch

- Instant Offices

- Office Freedom

- PropertyShark

- Regus

- City of Jacksonville

- LiquidSpace

- Offices.net

- Davinci [Ad]

So, at first glance, Regus appeared to account for only about 13% of the URLs listed (2 out of 15). However, as Jim soon learned after he began clicking on some the URLs listed, Regus's share of the page 1 results for this Google query was much higher than 13%.

Regus's Share Of Google's Page-1 Search Results

First, one of the fifteen results was not even relevant to Jim's search (the 12th URL, which led to a page operated by the City of Jacksonville that had nothing to do with available offices for rent in Jacksonville).

- LoopNet [Ad]

- Fresh Cowork [Ad]

- Regus [Ad]

- Easy Offices [ Ad]

- LoopNet

- CommercialCafe

- CommercialSearch

- Instant Offices

- Office Freedom

- PropertyShark

- Regus

- City of Jacksonville <– Not relevant

- LiquidSpace

- Offices.net

- Davinci [Ad]

So, that compressed the ratio for Regus's share from 2 out of 15 to 2 out of 14, when Jim's specific search intent was taken into account.

Second, ten of the fifteen (or 2 of 14, given our prior compression) results led to property search engines operated by office brokers who marketed available offices offered by companies like Regus.

- LoopNet [Ad] <– property search engine

- Fresh Cowork [Ad]

- Regus [Ad]

- Easy Offices [ Ad] <– property search engine

- LoopNet <– property search engine

- CommercialCafe <– property search engine

- CommercialSearch <– property search engine

- Instant Offices <– property search engine

- Office Freedom <– property search engine

- PropertyShark <– property search engine

- Regus

- City of Jacksonville

- LiquidSpace <– property search engine

- Offices.net <– property search engine

- Davinci [Ad]

So, really, these non-Regus URLs also directed Jim to Regus's advertisements for offices in Jacksonville, Florida; and, although those property search engines did not feature only Regus's advertisements, they did feature Regus's advertisements more prominently, or frequently, than office advertisements from other featured office providers.

For example, the highest ranking property search engine URL in the list above (the 4th URL) led to a property search engine page operated by Easy Offices. That page listed its own search results: there were nine properties listed for Jacksonville, Florida. Of those nine properties listed, seven of them were office locations offered by Regus, which meant that Regus's share of this particular property search engine page was around 78%.

The point, of course, is that it appears to have been statistically more likely that Jim would encounter Regus's office advertisements in the Google search results for office jacksonville florida than he would encounter office advertisements from any other office provider.

Regus's Dominance Of The Page-1 Google Search Results

To quantify Regus's dominance of the page-1 Google search results for the query office jacksonville florida, we might use the following equation variables:

- Regus has a 100% share of 2 of the 14 relevant search results (the 3rd and 11th URLs). So, that accounts for about 14% of the total available slots.

- Since the property search engine results appear to feature Regus's advertisements more prominently, or frequently, than office advertisements from other featured office providers (remember, the example we looked at found Regus to have had a 78% share of all featured properties on that property search engine), then it might be a reasonable guess that, on average, Regus accounts for 50% of all featured properties on the ten property search engine results we saw. So, we can blend that by estimating that Regus's share of the property search engine results is equal to 50% of the tend URLs, which would be about 36% of the total (14) available slots. (Based on the data we reviewed for this article, the appearance is that this 50% estimate is on the low side, as it strongly appears that Regus's dominance in the property search engine results is higher than 50%.)

- Just to point out some of the other data not incorporated into this equation, one key finding to note is that the page-1 search results for the Google query office jacksonville florida only featured two non-Regus office providers: the 2nd URL and the 15th URL, although, really, since the 15th URL is not relevant to physical office space (i.e. it's for "virtual office," which is not what Jim's Google search query was looking for), there would only be non-Regus office provider listed here. But, as with the estimate we used for Regus's share of the property search engine results, we'll use what we believe to be a conservative estimate. So, we'll pretend as though the 15th URL is also relevant, and say that non-Regus office providers account for 14% of the total available slots. (For our purpose here, that means that we would expect the final number we calculate to be 86% at most.)

So, to calculate our final number, we can add 14% to 36% (to account for the first two bullet-points above), and conclude that Regus's share of the page-1 search results for the Google query office jacksonville florida is 50%. That's an extremely dominant search-results position, and it explains why Jim had little chance to avoid encountering Regus's advertisements when he searched for office jacksonville florida.

Regus Is Hard To Avoid

As we'll cover in a later article, the significance of this hard to avoid trait for Jim was that he stood little chance to avoid being swept up in Regus's several schemes of misrepresentation (which Jim eventually had to detail in a complaint he filed against Regus with Florida attorney general's office), because the page-1 Google search results directed Jim to multiple URLs that either contained or eventually led to multiple instances of false advertisement by Regus, as Jim's attorney general complaint alleged.

A Matter Of Public Concern

If Regus's advertisements were harder to find, then the problem would not be so big. But since the opposite is true--they're hard to avoid--the scale of Regus's reported false advertisement is, or at least should be, a matter of public concern--and that's why the Florida attorney general's office should step in to investigate Regus each time it receives a complaint like Jim's.